In the third instalment of our mini-series Strengthening Retail Through Data we examine the necessity for and value to be gained from a single view of stock and customer data throughout your organisation.

Stock

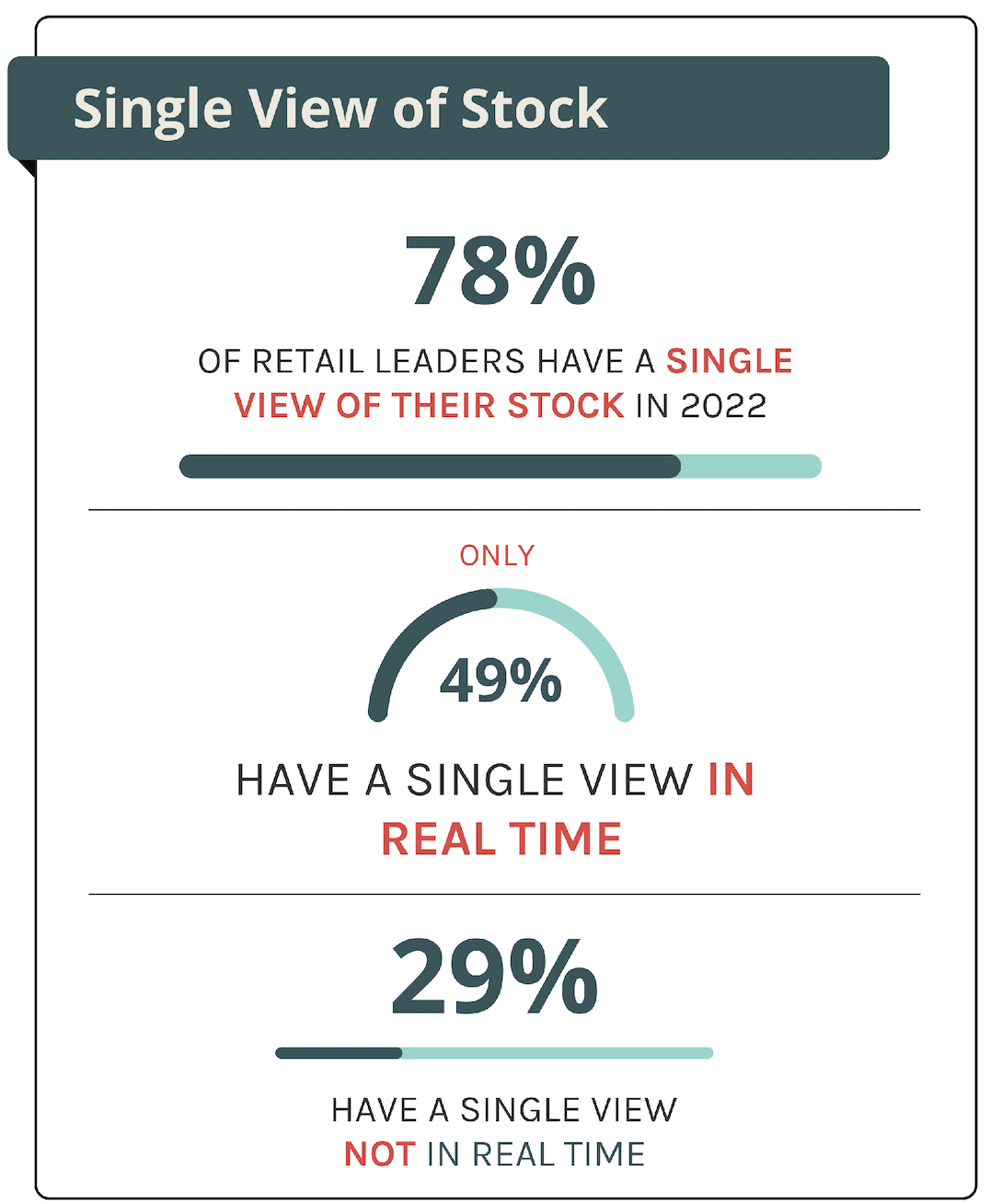

In a survey of over 50 top retail CEOs carried out by Retail Week, only 49% of respondents say they currently have a single view of stock in real time, while 29% have a single view not in real time.

Statistics provided by RETAIL WEEK in their report RETAIL 2023

Many retailers over ordered the wrong stock in 2022, tying working capital up in product and giving less room for manoeuvrability with changing customer demand. The lack of a consistent view of stock could well have contributed to this and many of the issues which resulted. Having a single view of stock across all channels of the business enables you to be far more targeted on buying the right products, and releasing capital tied up as the seasons change.

Given the continued uncertainty for the year ahead, many retailers have highlighted that forecasting is challenging given the current turbulence and unpredictability of the business environment.

Alex Loizou, co-founder and chief executive of online indie marketplace Trouva explained the situation clearly, saying,

“It’s therefore critical to go back to the fundamentals of how buying decisions are being made and how we use data to support these decisions while protecting ourselves from potential market fluctuations.”

Alex Loizou, CEO, Trouva

Most retail businesses will have accumulated data which can inform buying decisions, but this does not necessarily mean that it’s accessible to the people who need it the most, when they need it the most. Without a fully integrated and centralised view of data, presented in a way that key business stakeholders can understand, opportunities for sizable improvements are easily missed.

Customer

While stock levels appear to be relatively visible for today’s retailers, customer information is severely lacking. A mere 27% of top retail CEOs reported having a single view of their customer in real time. 31% say they do but not in real time and an incredible 31% acknowledge they do not have a single view of their customer at all. Arguably Customer Data is one of the most valuable assets a retail business has.

Statistics provided by RETAIL WEEK in their report RETAIL 2023

Whatever your current channel mix, retail is now more ecommerce-heavy than ever, and to ensure a good customer experience it is vital that delivery and fulfilment are efficient and offer options the customer wants. Timely access to good quality customer data is intrinsic to making this possible.

Personalised marketing is becoming increasingly important across all sectors, with retail leading the charge. Third-party identifiers, namely cookies, have been the standard method of identifying and sharing user data and supporting targeted marketing. With Google and Apple at the top of the list of those driving change, looking for these to be phased out by 2024.

Retailers are therefore sensibly increasing efforts to gather first-party data to leave them independent of a need of depreciating third-party identifiers. A principal method of gathering first-party data is by developing loyalty schemes or subscription services.

Even without the investment in loyalty or subscription service, retailers are collecting huge amounts of customer data at an individual and aggregate level which has huge value in informing how to personalise communication and drive the top line.

How You Can Achieve a Single View of Stock and Customer Data

Optimising use of this hard-earned data can only be done with a strong data architecture in place. An integrated data platform allowing a single view of customer across all touch points provides tangible ROI to the business and a massively improved experience for the customer.

Many retailers find themselves data rich but insight poor. By streamlining systems via a data platform, the potential scope of insight accessible is enormous.

Read the other parts of this series, Strengthening Retail Through Data at the links below:

Part 2: Changing Customer Expectations