Welcome to the second instalment of our mini-series Strengthening Retail Through Data. Today we are looking at the shift in consumer mindset and how this affects a Retailers go to market strategy.

Market Pressures & Changes

The 2022/23 rapidly increasing cost-of-living has driven consumer sentiment down to its lowest level since 1974, according to GfK. This coupled with rising inflation, last year having topped the 10% mark for the first time since 1982, food prices escalating at the fastest rate since 2008 and household energy bills doubling, the impact on consumer mindset is significant.

Retail businesses face the dual pressure of increasing costs in the supply chain, with customers also tightening their belts. Offering great product at good prices is more imperative than ever.

Operating as efficiently as possible and maximising any investment is critical. Understanding each step of the product and customer lifecycle in detail and in real time gives Senior Executives an impartial view of company performance.

Having a clear consistent view of data is necessary to identify parts of the business which are performing well and others which need to be enhanced. Too often, when questions are asked at Board level, an individual must manually pull together a report which is time consuming and not always accurate.

In a difficult market, data needs to be consistent, accurate and available to all levels of the business to drive a culture of continuous improvement and enable the business to pivot quickly if needed.

A data architecture providing the ability to identify where ROI is high, show where investment does not provide sufficient return and highlight efficiency increasing and cost-cutting options can and will determine the future of a company.

Such investments need to be seen as quick wins and demonstrate a clear and quick commercial advantage.

Impact on Channel Mix

During the height of the pandemic many retailers saw their digital transformation strategy as having been pushed forwards numerous steps, years even ahead of pre-existing plans.

Routes to market pivoted accordingly to adapt to the new reality of trading in lockdown. The main grocers for example, increased investment in online provisions, anticipating a future in which ecommerce played a much larger role in overall sales.

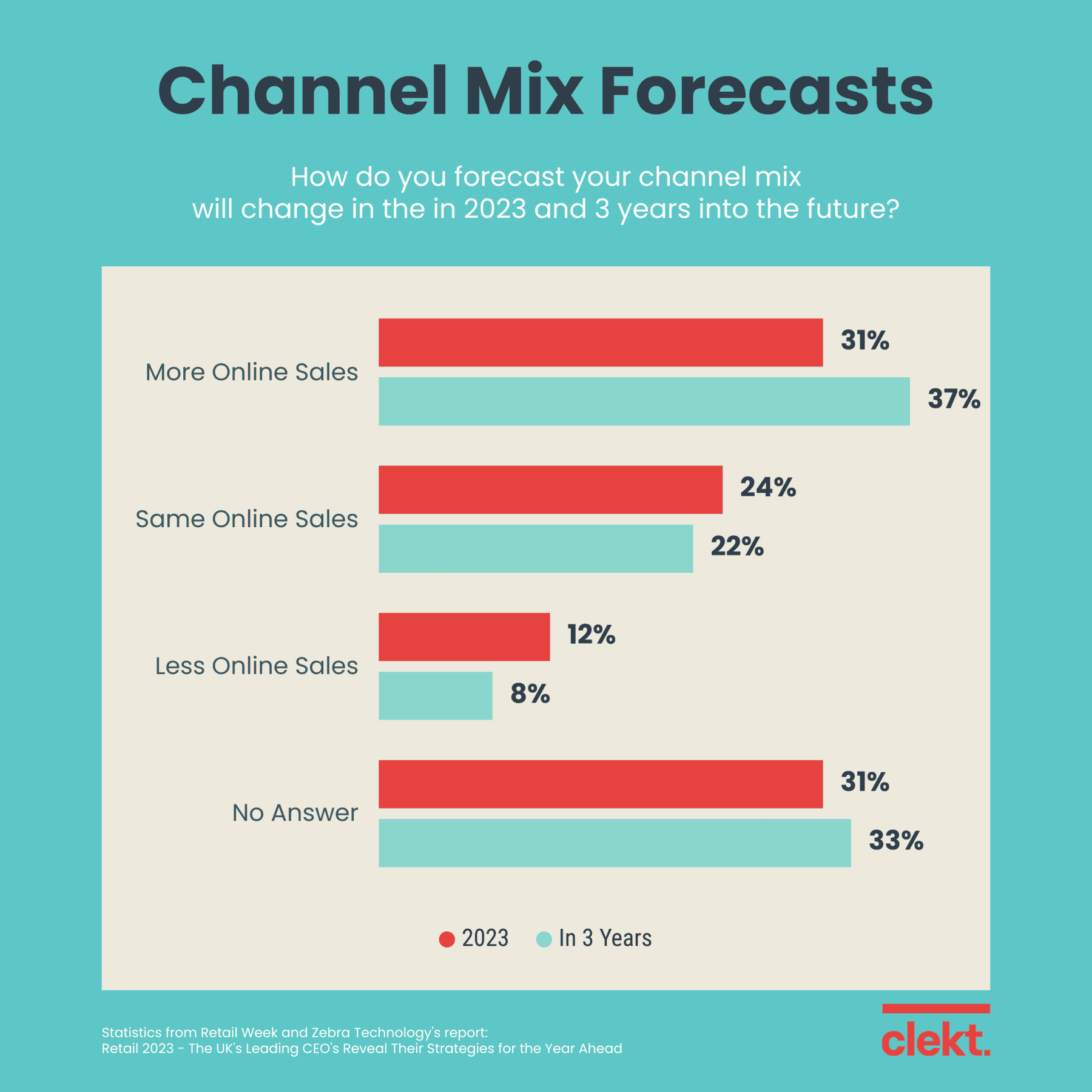

Channel mix forecast predictions according to leading retail CEO’s interviewed by Retail Week for their 2023 Retail Report.

Other realities in the following months included several well-established brands closing large numbers of stores, although on the other side some digital-native brands, such as Gymshark, have opened physical locations.

Each retailer’s ideal channel mix is distinct and dependent on having visibility of customer demographics and demand in a given geographical area. Determining this is only possible through the availability of and strategic use of data.

In the past, retailers knew the costs and the potential ROI of opening new stores, in a world where a physical storefront matters less and there a huge number of alternate ways to invest to drive sales, data should help inform decisions.

Ethical Awareness

Both Consumers and Retailers are also becoming more aware of their environmental and ethical obligations.

Recycling schemes and clothing take-back initiatives are becoming more commonplace. For example, our customer Jigsaw’s Resale offering, allows customers to recycle heritage Jigsaw pieces in return for store credit is one segment of their sustainability strategy.

Other brands such as Patagonia, Barbour and Currys now offer product repair services, in effort to reduce their environmental footprint and become more circular.

Customers are increasingly demanding to know the provenance of products to ensure they’re ethically sourced. With increasingly complex global supply chains, having accurate data here is half the battle for retailers.

While the requirement for demonstrating environmental impact is primarily customer and brand driven, there will increasingly be government regulation to demonstrate this, so retailers should be proactive in collecting and managing appropriate data now.

In summary through the retail market pressures and changes of our current landscape, having an agile business operation above all has proven vital.

The clear need for decision-making processes to be based on fact not assumption and fully considering issues resonating with the brands target audience are key factors in the survival of the modern retail brand. All these points require timely access to good quality data.

The best-run retailers will employ insights from their operating data to develop a channel strategy based on customer demand, running costs and revenue opportunity, whilst considering the effect channels have on each other. Systems connected through a modern data platform have this information to hand in real time.

Missed the first part of this retail focused series? Part 1 of Strengthening Retail Through Data – Why Data? Looks at how you can use data more effectively across all aspects of your retail business.

Catch up with the rest of the series below…