The Value of Data to the CFO

Data capture and analytics are now recognised as a critical tool in remaining competitive in modern business. The CFO is often heavily involved in leading digital and data transformation to a point where data provides value and drives decision making.

According to the latest EY DNA of the CFO survey, 25% of finance leaders think that “a culture of reporting the past, not predicting the future” is the biggest barrier to finance.

Data has always been essential to agile business planning, forecasting and analysis and as clearer views of company data become readily available, the need to outshine competitors in this area has become increasingly important. These elements are central to the role of the modern CFO.

Data is Essential to Agile Business Planning, Forecasting and Analysis.

Access to a single view of good quality company data provides the CFO with:

- Data challenges

- Cost savings and marketplace insights

- Uncovering new insights

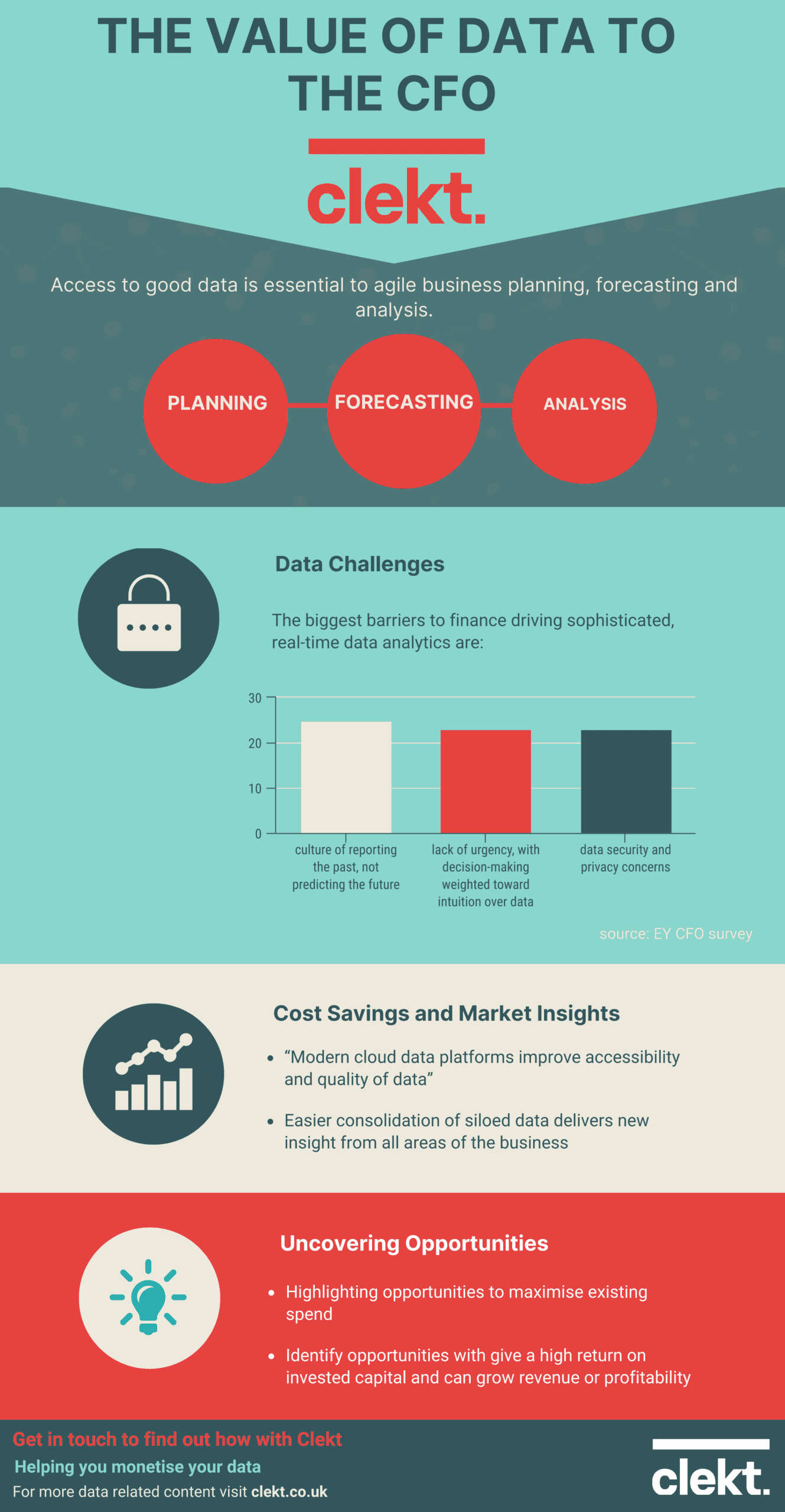

Data Challenges

The biggest barriers to finance driving sophisticated, real-time data analytics are:

A culture of reporting the past, not predicting the future

A lack of urgency, with decision-making weighted toward intuition over data

Data security and privacy concerns

Cost Savings and Marketplace Insights

Cloud based solutions save costs and increase accessibility of data.

Integration of previously siloed systems offer market insights previously impossible to achieve.

Uncovering New Insights

Modern cloud data platforms improve accessibility and quality of data.

Easier consolidation of siloed data delivers new insight from all areas of the business .

Where are you as a CFO in your Data Journey?

To start a conversation about how we can help your data offer ROI and positive business outcomes please get in touch